As a compliance officer, you play a crucial role in safeguarding your firm against regulatory risks. Building a robust compliance culture is essential not only for regulatory adherence but also for maintaining the trust of your clients and stakeholders. To help you with this vital mission, here are valuable pointers on establishing a strong compliance culture within your financial advisory firm.

Establish Clear Policies and Procedures

A strong compliance culture starts with well-defined policies and procedures that align with regulatory requirements. Ensure that these guidelines are accessible and clearly communicated to all employees. Remember to review and update your policies regularly to include any changes in the regulatory environment.

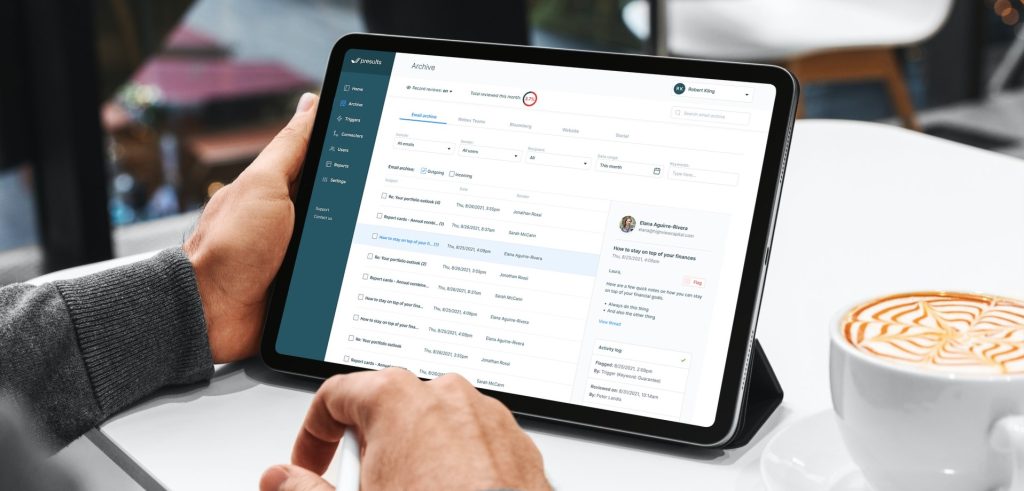

Promote Proactive Email Monitoring

Email communication is a significant area of risk for financial advisors. Implementing proactive email monitoring software, such as Presults, can help identify and mitigate potential compliance breaches. Presults automatically scans and flags emails that contain non-compliant keywords before they get sent to the client.

Regular Reviews of Client Communication

Conduct regular reviews of client communications to ensure adherence to regulatory requirements. With vast amounts of communications to review and consistently changing regulations, it’s recommended to invest in technology to aid in internal reviews. For example, Presults can reduce the manual time spent on email reviews by 90%.

Foster a Culture of Accountability

Compliance is the responsibility of everyone. Achieving this involves keeping employees informed about the latest regulatory updates and best practices, and providing them with both human and technological support. Presults educate advisors about compliance by informing them when words or key terms they want to use are non-compliant.

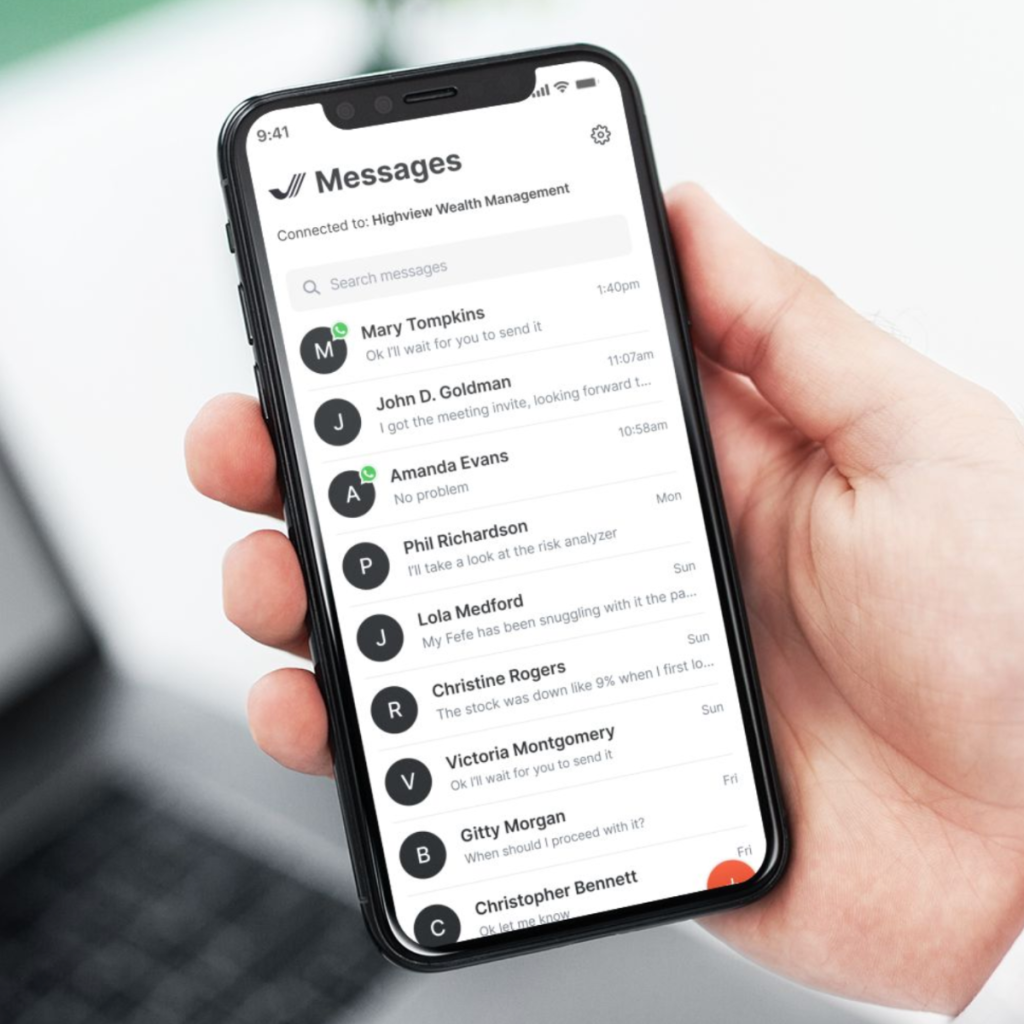

Leverage Modern Technology for Compliance Management

When it comes to building a strong compliance culture at your advisory firm, it’s important to invest in modern technology solutions that can streamline compliance management processes. Just as you keep your website up-to-date, you should also ensure that your compliance software is modern and equipped with the latest technological advancements, such as automation and AI.

It’s essential to evaluate your compliance tools to make sure they are up-to-date with the ever-changing digital communication platforms that clients expect.

Ready to Enhance Your Compliance Culture?

Building a robust compliance culture is an ongoing journey that requires commitment and the right resources. At Presults, we offer comprehensive solutions designed to support your compliance efforts. Schedule a demo with our experts today to learn how we can help you achieve a robust compliance culture.