How to Build a Robust Compliance Culture at Your Advisory Firm

Essential strategies to build a robust compliance culture in your financial advisory firm to safeguard against regulatory risks.

Essential strategies to build a robust compliance culture in your financial advisory firm to safeguard against regulatory risks.

Explore the practical benefits of platform choice for financial advisory firms. Learn how leveraging diverse digital channels enhances client engagement and empowers advisors.

Learn top tips on how financial advisors can utilize private LinkedIn messaging to attract and retain clients.

How to retain and attract the next generation of clients as a financial advisor to future-proof your business.

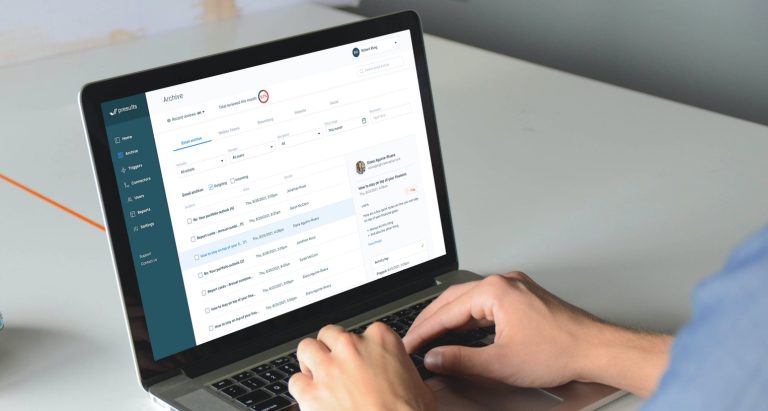

Discover how True West Consulting’s partnership with Presults is streamlining compliance processes for financial advisory firms and mitigating risks with modern communication archiving technology.

Discover what financial advisors should seek in an archiving solution to enhance compliance, efficiency, and effectiveness.

Proactive compliance is not just more cost-efficient for financial advisory firms, but it saves them hours and headaches down the road.

LinkedIn can be a powerful and free tool to market your financial advisory firm if done correctly. Learn top strategies to utilize LinkedIn to market your financial advisory firm, setting you apart and generating more leads.

Are you making these common archiving mistakes at your financial advisory firm? Learn what the common mistakes are so that you can stop them in their tracks and ensure compliance.

Financial Advisors need to ensure that their social media remains compliant. Here is a guide to ensure your advisory firm follows the governing rules for social media archiving.

Advisors have a duty to protect client data. Learn what steps you can take to proactively watch over the valuable data of your clients.

How you can use AI to create a more efficient, cost-effective, and robust compliance program.